Managing finances effectively often involves having a safety net for unexpected expenses. For those navigating tight budgets, overdraft services can provide short-term relief when funds fall short. However, traditional overdraft services often come with high fees that can strain finances further. This is where fee-free overdraft services become a game-changer. Understanding what is fee free overdraft and its advantages can empower individuals to make smarter financial decisions while avoiding unnecessary charges.

Eliminates Costly Overdraft Fees

Fee-free overdraft services help users avoid the steep charges typically associated with overdrawing an account. Traditional overdraft services often impose fees ranging from $20 to $40 for each transaction that exceeds the account balance. SoFi’s fee-free overdraft coverage ensures users can manage unexpected expenses without incurring these burdensome penalties, providing a practical and cost-effective solution for financial shortfalls. This approach offers both immediate relief and long-term savings, making financial emergencies less stressful.

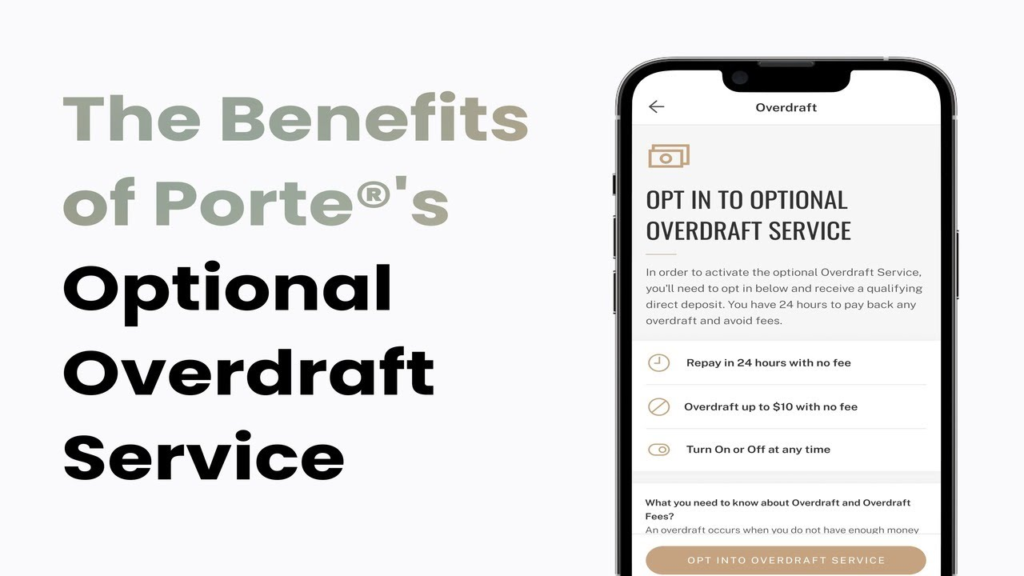

Users can access a set amount of overdraft protection without incurring penalties by opting for a fee-free service. This not only saves money but also offers peace of mind during emergencies or when timing issues, such as pending deposits, lead to temporary account shortages.

Encourages Better Financial Management

Fee-free overdraft options promote financial responsibility by giving account holders more control over their funds. Unlike traditional overdraft systems that penalize every overdrawn transaction, fee-free services often have limits or caps that encourage users to monitor spending and stay within budget.

This structure gently reminds those trying to develop healthier financial habits to be mindful of account balances. It allows users to cover urgent expenses without the fear of accumulating debt, fostering a sense of empowerment and control over personal finances.

Improves Accessibility to Essential Services

Traditional overdraft services often exclude individuals who may not meet specific financial criteria, such as maintaining a minimum account balance or meeting income thresholds. Fee-free overdraft services, however, are designed to be more inclusive and accessible, making them an excellent option for students, part-time workers, and individuals with fluctuating incomes.

This accessibility ensures that essential expenses, such as utility bills or medical costs, can still be managed even during times of financial uncertainty. Fee-free overdraft services remove barriers, enabling more individuals to access the support they need without the fear of punitive charges.

Supports Emergency Financial Needs

Emergencies are unpredictable, and having access to a fee-free overdraft can significantly improve emergency management. Whether an unexpected car repair or a surprise medical bill, fee-free overdraft services provide a buffer to cover immediate costs without the added burden of fees.

This support system is precious for those lacking access to other short-term credit forms. It allows individuals to focus on resolving the situation instead of worrying about managing fees that may arise from their temporary financial shortfall.

Boosts Long-Term Savings

Users of fee-free overdraft services can redirect those savings toward other financial goals by eliminating fees. The funds that would have gone toward paying overdraft penalties can instead be used to build an emergency fund, pay off existing debts, or invest in future needs.

This shift improves short-term financial stability and contributes to long-term financial health. Over time, the cumulative savings from avoiding overdraft fees can have a meaningful impact, creating a stronger foundation for achieving financial independence.

Fee-free overdraft services provide a practical solution for managing financial shortfalls without the burden of traditional overdraft fees. By eliminating unnecessary costs, encouraging responsible financial habits, and supporting emergency needs, these services empower individuals to take control of their finances. For anyone seeking a cost-effective and accessible way to handle temporary account shortages, fee-free overdraft services represent a more intelligent, sustainable choice.